One of the first questions I always get from small business owners is, "How much should I actually be spending on marketing?" The honest answer? It really depends. While you'll often hear a general guideline of 5% to 10% of your annual revenue, that's just a starting point. Your real number depends entirely on where your business is today and where you want it to be tomorrow.

Building Your First Marketing Budget

Let's get practical and move beyond generic advice. That classic "10% of revenue" rule is a decent benchmark, but it doesn't account for the unique reality of your company. Your budget should be a direct reflection of your current situation and your biggest ambitions.

Think about a brand-new startup, for instance. Its main job is to make a splash and get noticed. The primary goal is building awareness—getting the brand name out there and attracting those crucial first customers. This calls for a more assertive strategy, often pushing the marketing spend closer to 15-20% of projected revenue.

Now, contrast that with an established local shop that has a loyal customer base and steady foot traffic. Its priorities are different. The focus might be on nurturing that loyalty and driving slow, steady growth. In a scenario like this, a more conservative budget of 5-8% could be more than enough to get the job done.

Finding Your Starting Number

Here in the UAE and across the Middle East, the push toward digital is shaping how small businesses approach their marketing spend. We're seeing most SMEs allocating around 5% to 10% of their annual revenue to marketing, with a significant chunk of that now going toward digital channels.

The most important mindset shift is to see your marketing budget not as a cost, but as a direct investment in your company's growth. A well-planned budget is what fuels your ability to find new leads, win over customers, and build a lasting brand.

To get a clearer picture of the financial side of things, it's also smart to look at benchmarks from other developed markets. This guide on UK Small Business Advertising Costs Explained provides some really valuable insights into how different channels are priced, which can help inform your own decisions.

To help you visualize this, let's walk through a few concrete examples. The table below shows how your revenue and business stage come together to shape a realistic starting budget.

Sample Marketing Budget Scenarios by Business Stage

This table shows sample budget allocations based on a percentage of annual revenue, adjusted for different business growth phases.

| Business Stage | Annual Revenue (AED) | Recommended Marketing Allocation | Example Annual Budget (AED) |

|---|---|---|---|

| Startup / Launch Phase | 250,000 | 15% | 37,500 |

| Growth Phase | 750,000 | 10% | 75,000 |

| Established / Maturity Phase | 2,000,000 | 7% | 140,000 |

| Aggressive Expansion | 5,000,000 | 12% | 600,000 |

Looking at it this way helps remove the guesswork. By tying your budget to your specific business stage and revenue, you can create a plan that's both ambitious and grounded in reality.

Connecting Your Budget to Business Goals

A marketing budget without a clear purpose is just an expense. It's like heading out for a drive with a full tank of gas but no destination in mind—you’ll burn through resources without ever arriving anywhere meaningful. To make every dirham work for you, your spending has to be tied directly to tangible business outcomes.

It's time to get specific. Forget vague ideas like "get more customers" and start defining what success actually looks like for your business.

Defining What Success Looks Like

This is where we move from wishful thinking to strategic planning by setting SMART goals: Specific, Measurable, Achievable, Relevant, and Time-bound. A weak goal is "increase sales." A powerful, actionable goal is "achieve a 15% increase in online sales from our e-commerce store within the next quarter." See the difference? One is a wish; the other is a roadmap.

Your unique business goals are what should shape your budget. A local café in Dubai trying to build its name will spend its money very differently than an online retailer laser-focused on acquiring new customers.

Let's look at a few real-world scenarios:

-

For Brand Awareness: That café might invest in sponsoring a local community event, collaborating with Dubai-based food bloggers on Instagram, and running geo-targeted social media ads. Here, success isn't just about sales. It's measured by an increase in local search traffic, a jump in social media followers from the surrounding neighborhoods, and more people walking through the door during quiet hours.

-

For Lead Generation: A B2B consultancy, on the other hand, needs a steady stream of qualified leads. Their budget is better allocated to things like LinkedIn ads targeting specific job titles, developing in-depth articles, and running targeted email campaigns. Success is measured by the number of demo requests or contact forms submitted. To go deeper, you can explore these proven B2B marketing strategies to attract high-value leads.

-

For Customer Acquisition: An e-commerce store lives and dies by turning clicks into sales. Their budget will heavily favor channels with a direct path to purchase, like Google Shopping ads and Facebook retargeting campaigns. The ultimate metric here is Customer Acquisition Cost (CAC)—how much you spend to get one new paying customer.

By defining success first, you transform your marketing budget from a list of expenses into a strategic plan for growth. Each activity is chosen not because it's popular, but because it directly contributes to a tangible business objective.

This alignment ensures your money is funneled precisely where it will make the biggest difference. Whether your goal is to boost online leads by 30% or drive more foot traffic to your shop in Jumeirah, this approach gives you clarity. It forces you to ask the most important question for every single expense: "How will this get us closer to our target?"

Alright, you've figured out how much to spend. Now for the fun part: deciding where to spend it. This is where the real strategy comes into play, and it’s about more than just picking a channel and hoping for the best. A smart marketing budget is a carefully crafted mix, designed to hit your specific goals.

Think of it as building a portfolio. You wouldn't put all your money into one stock, right? The same logic applies here. You need a blend of foundational, long-term investments and some high-impact, short-term plays.

Foundational pillars like Search Engine Optimization (SEO) and good old-fashioned content marketing are your slow-and-steady growers. They build your brand’s credibility and organic footprint over time. On the other hand, paid channels like social media ads or Google Ads are your sprinters—built to get you leads and sales right now. A winning strategy needs both. You want the compounding growth from your content and SEO, but you also need the quick wins that paid ads can deliver.

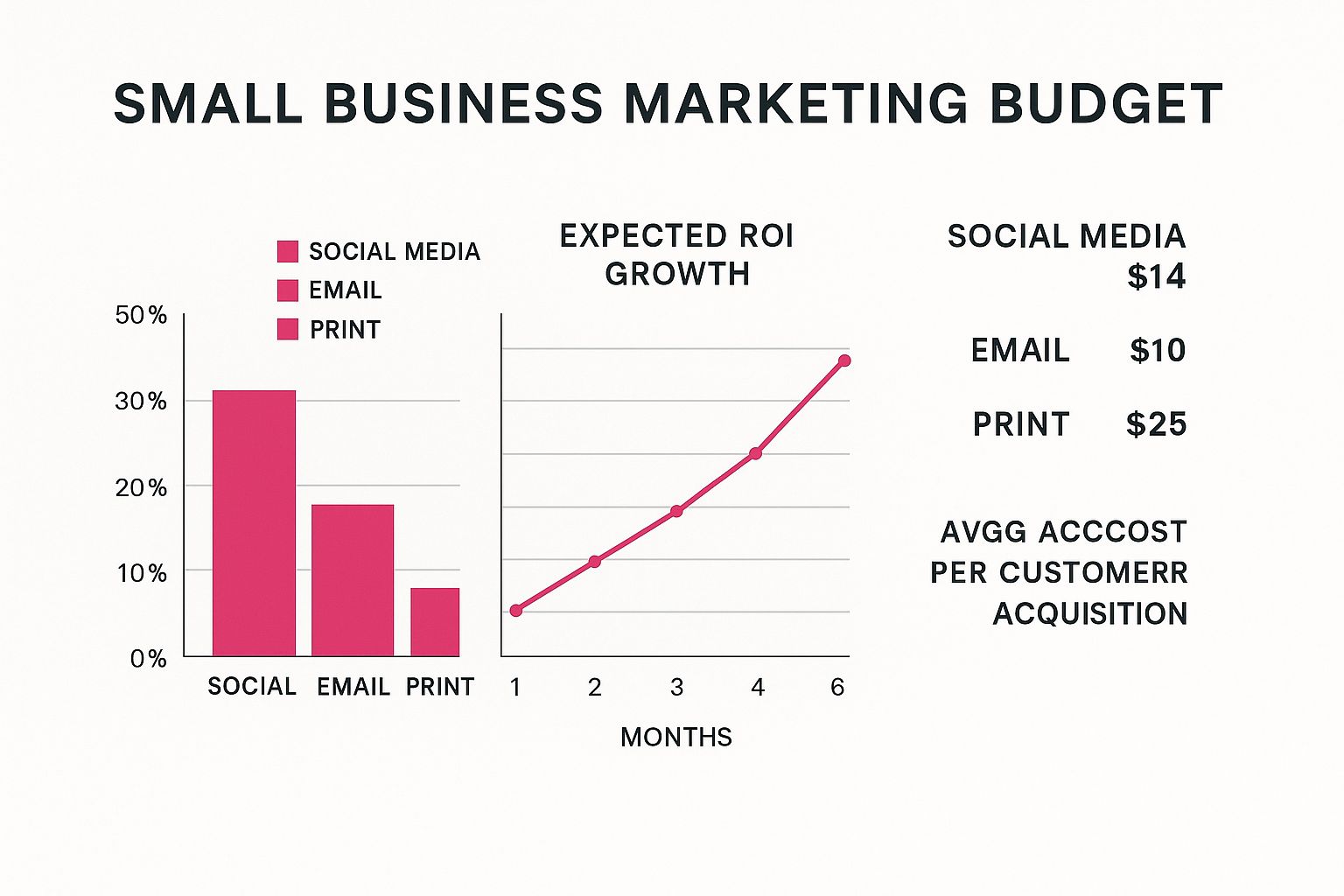

The image below gives you a sense of how different channels can perform, showing typical budget splits, expected ROI, and customer acquisition costs.

It’s a great visual for understanding how to balance your spending between what pays off today and what builds your business for tomorrow.

Tailoring Your Channel Mix to Your Business

Let me be clear: there’s no magic formula here. The perfect marketing mix is completely unique to your business, your customers, and your industry.

For instance, if you're a local service business—say, a plumber in Sharjah—your money is best spent on local SEO and geo-targeted Google Ads. Why? Because you need to show up when someone in your area desperately searches for "plumber near me."

But if you run a direct-to-consumer fashion brand, your playbook looks totally different. You'll want to pour your budget into highly visual platforms like Instagram and TikTok, building a community and driving sales where your audience hangs out.

My best advice? Your budget allocation should be a direct reflection of your customer's journey. Put your money where your ideal customers are most likely to find you, get to know you, and ultimately, buy from you.

As you decide where to invest, really dig into the specifics of each platform. If Instagram is your go-to, for example, it's worth learning the ins and outs of Instagram marketing for small businesses to make every dirham count.

Putting Your Budget to Work: A Practical Look

Let's look at how you might actually split up a budget. This table shows a sample allocation across a few common channels. It's just a starting point, but it gives you an idea of how to think about assigning percentages based on what you want to achieve.

Example Marketing Channel Budget Allocation

| Marketing Channel | Budget Allocation (%) | Primary Goal |

|---|---|---|

| SEO & Content Marketing | 25% | Build long-term authority, organic traffic |

| Paid Social Media | 20% | Drive immediate traffic, lead generation |

| Google Ads (PPC) | 20% | Capture high-intent searchers, sales |

| Email Marketing | 15% | Nurture leads, customer retention |

| Influencer Marketing | 10% | Build brand trust and social proof |

| Traditional/Local Ads | 10% | Reach specific local demographics |

This kind of percentage-based approach helps ensure you're creating a balanced marketing engine, not just a one-trick pony. Remember to adjust these based on what your performance data tells you over time.

To give you an even clearer picture, here’s how two very different businesses might divvy up their funds based on their unique needs.

Scenario 1: Local Service Provider (e.g., an AC Repair Company)

- Local SEO & Google Business Profile (35%): This is non-negotiable. It’s how you win those urgent "near me" searches.

- Google Ads (30%): You're targeting people with an immediate problem. This gets you in front of them the moment they search.

- Content Marketing (15%): Writing blog posts about common AC issues or maintenance tips builds trust and establishes you as the local expert.

- Email Marketing (10%): Perfect for sending seasonal maintenance reminders and keeping past customers coming back.

- Social Media (10%): Mostly for sharing glowing customer reviews and building a reputation for reliability in the community.

Scenario 2: E-commerce Fashion Brand

- Social Media Ads (40%): Heavily focused on Instagram and TikTok. These platforms are visual, shoppable, and where the target audience lives.

- Influencer Collaborations (25%): Partnering with fashion influencers gets your brand in front of curated audiences and provides powerful social proof.

- Content & SEO (20%): Creating style guides, trend reports, and lookbooks helps you show up in organic search when people are looking for inspiration.

- Email & SMS Marketing (15%): Essential for announcing new arrivals, running flash sales, and encouraging repeat purchases from your biggest fans.

Measuring Your Marketing ROI

Getting your marketing budget set is a huge step, but it’s only half the job. Now for the crucial part: proving that every dirham you spend is actually bringing in business, not just adding to your expenses. This is where you connect the dots between your marketing spend and your revenue, showing everyone the real value of your work.

Measuring your Return on Investment (ROI) might sound intimidating, but you don’t need a degree in data science to get it right. It’s really about knowing what to track and, more importantly, understanding what the numbers are telling you. Once you get a handle on a few key metrics, you’ll unlock insights that not only justify your budget but also help you make much smarter decisions going forward.

Key Metrics You Need to Track

To get a truly clear picture of what’s working, you only need to focus on a few essential metrics. These are the numbers that reveal the real financial impact of your marketing efforts.

-

Customer Acquisition Cost (CAC): This is your total marketing and sales cost divided by the number of new customers you brought in over a set period. In other words, how much are you paying to get one new customer through the door?

-

Customer Lifetime Value (LTV): This metric predicts the total revenue you can expect from a single customer over the entire time they do business with you. A high LTV is a fantastic sign that you’re not just attracting customers, but keeping the right ones.

-

Return on Ad Spend (ROAS): This one is specific to your paid ads. It measures the gross revenue you generate for every single dirham you spend on advertising. It’s a straightforward way to see which of your campaigns are actually making you money.

The golden rule here is pretty simple: Your LTV should be significantly higher than your CAC. Most experts agree a healthy ratio is around 3:1, meaning a customer’s value is at least three times the cost it took to acquire them.

If your numbers aren't lining up, don't panic. It's just a clear signal that it's time to take another look at your strategy—maybe a channel isn't performing, or your messaging isn't quite hitting the mark. You can dive deeper into this by exploring various marketing performance indicators to find the ones that best fit your business goals.

Simple Tools for Clear Insights

The good news is you don’t need to invest in expensive, complicated software to start tracking your performance. Many of the tools you’re likely already using have powerful, built-in analytics that can give you all the data you need.

-

Google Analytics: An absolute must-have. This free tool is the gold standard for tracking website traffic, understanding how users behave on your site, and monitoring conversion goals. You can quickly see which channels are sending you the most visitors and which pages are actually turning into sales.

-

Native Social Media Dashboards: Platforms like Facebook, Instagram, and LinkedIn all provide their own detailed analytics. Use them to track post engagement, audience reach, and the performance of your paid ads.

-

E-commerce Platform Reports: If you have an online store on a platform like Shopify or BigCommerce, you have a goldmine of data at your fingertips. Their built-in reports can track sales, conversion rates, and average order value, giving you a direct line of sight into your store's health.

For e-commerce businesses running on specific platforms, like Magento 2, getting your conversion tracking right is non-negotiable for proving the value of your Google Ads. Learning how to set up Magento 2 Google Ads conversion tracking is a game-changer. It provides the detailed data you need to fine-tune your campaigns and make sure your ad spend is directly contributing to your bottom line.

Don't Set and Forget: Keeping Your Budget Agile for Growth

One of the biggest mistakes I see small business owners make is treating their marketing budget like it’s carved in stone. They draft it up once a year and then file it away. But your budget shouldn't be a static document. Think of it as a living, breathing plan that needs to evolve right alongside your company. The most successful businesses are dynamic, always ready to pivot based on what the real-world data is telling them.

This kind of agility starts with regular, scheduled reviews. Please don't wait until the end of the year to find out what worked and what was a waste of money. A quarterly check-in is the perfect rhythm. It forces you to look at the results and make smart adjustments, giving you the chance to be nimble. You can shift funds away from underperforming campaigns and double down on the strategies that are clearly delivering a positive return.

Imagine you're running LinkedIn ads for B2B leads and they're bringing in fantastic conversions. At the same time, a local print ad you’ve been running isn’t moving the needle at all. The decision is simple. You can confidently pull that print budget and pump it into your winning LinkedIn campaign for the next quarter.

Knowing When It’s Time to Spend More

Beyond just moving money around, you also need to recognize the signals that it's time to increase your overall budget. These are the green lights telling you that your business is ready for its next growth spurt and that your marketing needs more fuel to get there.

Keep an eye out for these tell-tale signs:

- You've Hit a Plateau: Are your leads drying up? Have sales flattened out even though your current marketing is running smoothly? That's a classic sign you've maxed out what your existing budget can do.

- Your Competitors Are Everywhere: If you suddenly start seeing competitors showing up more often in search results or social media ads, they're probably outspending you. You may need to invest more just to maintain your current market share.

- You Have a High Customer Lifetime Value (LTV): When your data shows that acquiring a customer leads to significant long-term spending, you can afford to increase your Customer Acquisition Cost (CAC). It's a clear signal to spend more to attract those valuable customers.

A common mistake is waiting too long to scale. If a marketing channel is consistently delivering a 3:1 return or better, it’s not a risk to increase the budget—it’s a calculated investment in predictable growth.

How to Scale Your Budget Intelligently

As your revenue grows, your marketing spend should grow with it. The most straightforward way to manage this is to stick to the percentage-of-revenue model we discussed earlier. If you’ve committed 10% of your revenue to marketing, your budget automatically increases as your sales climb. This creates a powerful, self-sustaining growth cycle where marketing success directly fuels future marketing investment.

This method keeps your expansion sustainable. You avoid overextending your finances, but you're still empowering your marketing team to keep pace with your ambitions. To get more ideas on building out a powerful strategy, check out our complete guide to digital marketing for small business, which digs into everything from the basics to more advanced tactics. It will help ensure every dollar in your growing budget is put to its best possible use.

Frequently Asked Questions

When you start digging into marketing budgets, a lot of questions tend to pop up. It's completely normal. Here, I'll walk you through some of the most common ones I hear from small business owners, offering some straightforward advice to help you plan with confidence.

Let's clear up some of the trickier parts of putting together a financial plan for your marketing.

How Much Should a Brand New Small Business Spend on Marketing?

When you’re just starting out, you have to make some noise. There’s no getting around it. For a brand new business, I usually recommend setting aside a healthy chunk of your projected revenue for marketing—think somewhere in the 12% to 20% range.

This might sound like a lot, but this initial investment is crucial for building awareness from zero. It's how you'll land your first customers and, just as importantly, gather data on what's actually resonating with people. An established business has the luxury of repeat clients and word-of-mouth referrals. You don't have that yet, so you need to invest to gain that early momentum.

This foundational budget should be spent on high-impact activities that set you up for success:

- A professional website is non-negotiable; it's your digital storefront.

- A solid social media presence on the platforms your ideal customers actually use.

- Targeted digital ads to get some initial traffic and start generating leads.

What Are the Best Marketing Channels for a Very Tight Budget?

When every dirham has to work overtime, you need to focus on channels that reward sweat equity more than big spending. Honestly, one of the most powerful and lowest-cost options is content marketing—like starting a business blog.

You should also pour some energy into optimizing your Google Business Profile for local search and keeping up with organic social media. These build trust and become long-term assets. Email marketing also delivers an incredible ROI, especially once you start building a small list from your first few customers.

These strategies are more of a marathon than a sprint. They require your time and consistency, but they can produce incredible results without the hefty price tag of paid ads, building sustainable growth over the long haul.

Should I Include Salaries in My Marketing Budget?

Yes, absolutely. If you want a true picture of what your marketing actually costs, you have to include people-related expenses. This is the only way to get a complete view of your investment in acquiring and keeping customers.

This means accounting for the salary of a full-time marketing hire or even just the portion of another employee's time that's spent on marketing tasks. It also includes any fees you pay to freelancers for things like blog writing or payments to an agency managing your SEO. These are all direct marketing expenses.

This isn't just about tidy bookkeeping. Including these costs allows you to accurately calculate your total marketing ROI, weighing every single dirham spent against the revenue it brings in. That clarity is what helps you make smart, data-backed decisions about where to put your money for future growth.

Ready to stop guessing and start growing? Grassroots Creative Agency develops data-supported marketing strategies that connect your budget directly to your business goals. Learn how we can help your small business thrive.