Calculating customer lifetime value (CLV) is about much more than just plugging numbers into a formula. It's a fundamental shift in how you see your business, moving your focus from the quick hit of a single sale to the enduring value of a long-term relationship. This one metric cuts through the noise to show you the total net profit you can expect from a customer, making it a powerful guide for everything from your marketing spend to your product roadmap.

Why CLV Is Your Most Important Business Metric

Let's get practical. Once you truly understand your CLV, it changes how you think and act. You stop treating every new customer as equal. Instead, you start to see that some customers are worth exponentially more to your business over time.

This isn't just about spotting the big spenders. It’s about digging into why they’re so valuable. Do they buy more often? Are they drawn to your higher-margin products? Do they stick with you for years, providing a steady stream of predictable revenue? Figuring this out is the first step toward building a more robust and resilient business.

The Strategic Shift From Transactions to Relationships

When you have a handle on customer lifetime value, you give your teams a sharper tool for making decisions. Your marketing team, for example, can finally move beyond surface-level metrics and zero in on what really matters: the CLV to Customer Acquisition Cost (CAC) ratio.

Think about it. If you know the average customer is worth $2,000 throughout their time with you, you can make much smarter decisions about how much to spend to bring them in. This simple fact stops you from wasting money chasing low-value customers who churn after one purchase. It also gives you the confidence to invest more to attract the right kind of customers—the ones who look just like your most profitable segment.

CLV isn’t just a number that looks backward; it's a predictive tool that shapes your entire growth strategy. It tells you who to find, how to keep them, and what they're truly worth to your bottom line.

Aligning Your Entire Organization

The influence of CLV reaches far beyond marketing. It creates a shared definition of success that gets everyone, from product to customer service, on the same page.

- Product Development: By looking at what your high-CLV customers buy, your product team gets direct insight into what features to build next. They can tailor their efforts to what your best customers actually want, which boosts satisfaction and keeps them coming back.

- Customer Service: CLV data helps you rethink your support strategy. Maybe your most valuable customers get proactive check-ins or are routed to priority support. You're not just solving a problem; you're protecting a significant, long-term revenue stream.

- Sales and Marketing: With this insight, your teams can build smarter campaigns. They can target prospects who share the same traits as your best customers, which means better leads and higher conversion rates.

This unified view completely changes your approach to growth. The goal is no longer about constantly filling a leaky bucket with new leads. It becomes about building a solid, sustainable base of loyal customers. For a deeper dive into how CLV fits with other critical metrics, check out our guide on key marketing performance indicators.

We’re seeing this evolution play out in advanced markets right now. For instance, the retail sectors in the UAE and MENA region are doubling down on creating integrated customer ecosystems to drive engagement and, ultimately, CLV. The potential revenue from these platforms is staggering—estimated at around $1 trillion—which underscores just how valuable fostering these long-term customer relationships has become.

Gathering the Right Data for an Accurate CLV Calculation

To get a truly useful CLV number, you need solid data. The old saying "garbage in, garbage out" has never been more relevant. A reliable calculation starts with clean, organized information pulled from the right places.

This isn't about needing a data science degree. It's simply about knowing which numbers matter and where to find them in the tools you already use. The goal is to build a dependable dataset that sidesteps the common errors that can sink a CLV analysis before it even starts.

Identifying Your Core CLV Metrics

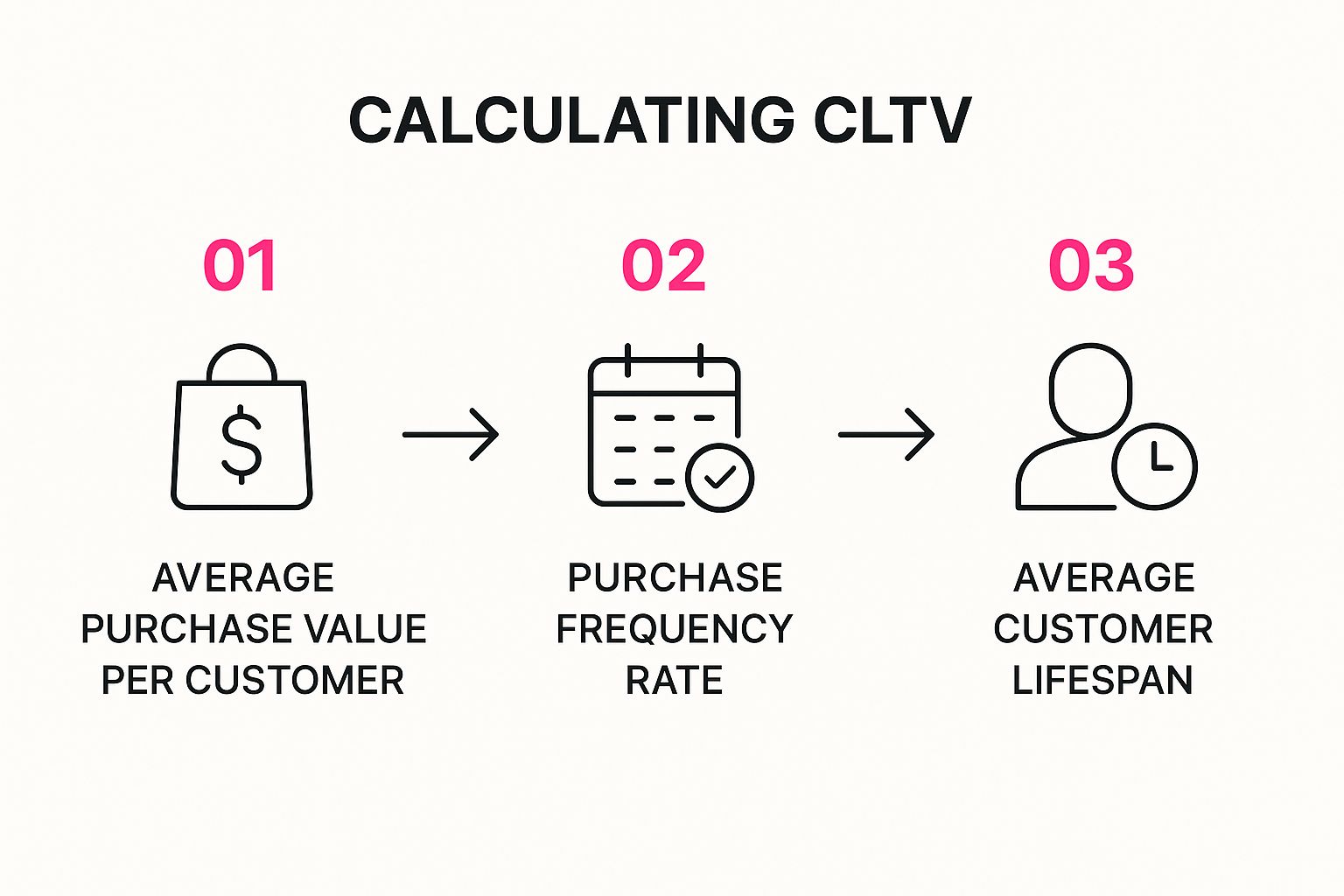

Before you can pull any numbers, you need a clear shopping list. The basic CLV calculation relies on a handful of key metrics that, together, tell the story of your customer relationships. Think of these as the essential ingredients for your CLV formula.

Here are the data points you'll need to hunt down:

- Average Purchase Value (APV): This is the average dollar amount a customer spends in a single transaction. It gives you a clear baseline for what each sale is worth to your business.

- Purchase Frequency (F): This metric tells you how often your average customer makes a purchase over a set period, like a year or a quarter. It's a direct signal of their engagement and loyalty.

- Average Customer Lifespan (L): This is the length of time you can realistically expect to keep a customer. For subscription businesses, this is pretty straightforward. For e-commerce, it usually requires a bit of smart estimation based on your churn rate.

Once you have these three numbers, you can start to see how your customer relationships translate into real value over time.

Your CLV calculation is only as strong as the data you feed it. Taking the time to locate and verify these core metrics from reliable sources is the most critical step in the entire process.

Where to Find Your Customer Data

So, you know what you need—but where do you get it? Most businesses already have this information tucked away in their various platforms. The trick is knowing which system holds which piece of the puzzle.

Your data is likely spread across a few key operational hubs. For a typical e-commerce or service-based business, you'll find what you're looking for in these places:

- Your E-commerce Platform: Systems like Shopify, WooCommerce, or Magento are treasure troves of transactional data. They house your total revenue and order counts, which are crucial for figuring out your Average Purchase Value.

- Your CRM System: A Customer Relationship Management tool like HubSpot or Salesforce tracks individual customer histories and interactions. This is usually the best spot to find the number of unique customers and total orders needed for your Purchase Frequency calculation.

- Your Payment Processor: Services like Stripe or PayPal offer clean, simple records of every transaction. They can be a fantastic primary source—or a great backup—for revenue and order numbers if your other systems are a bit messy.

When you're getting your raw data ready for analysis, you might need it in a flexible format like CSV. If your data is in spreadsheets, you can learn more about converting data from Excel to CSV to make it easier to import into other tools.

I'd recommend auditing these sources to see which one gives you the most consistent and complete picture. Once you've picked your primary sources, you can create a repeatable process for pulling this information. This foundational work ensures your CLV calculations stay accurate over time and makes every other step in the analysis that much smoother.

Alright, you've got your customer data cleaned up and organized. Now for the fun part: running the numbers to figure out what your customers are actually worth. This isn't about getting lost in complex data science. Instead, we're going to walk through some straightforward formulas that turn customer behavior into a real, tangible financial metric.

We'll look at the two main ways to do this: the historic model and the predictive model. Each one gives you a different lens through which to view customer value, and understanding both will help you move beyond just tracking sales. You'll start to see the long-term potential locked inside your customer relationships.

The Historic CLV Model: A Snapshot of Past Performance

The most direct route to calculating CLV is the historic model. As the name suggests, it’s all about looking back at past transactions to figure out what an average customer has been worth to you so far. It's the perfect place to start because it's simple, quick, and gives you a solid baseline.

To get this number, you'll need the metrics we talked about gathering earlier:

- Average Purchase Value (APV): The typical amount a customer spends in one go.

- Average Purchase Frequency (F): How many times a customer buys from you in a set period, like a year.

- Average Customer Lifespan (L): How long a customer typically stays with your business.

The formula itself is pretty intuitive. You're just putting those pieces together:

Historic CLV = (Average Purchase Value x Average Purchase Frequency) x Average Customer Lifespan

This simple equation gives you a powerful figure: the total revenue an average customer has brought into your business over their entire relationship with you.

This infographic breaks it down visually, showing how each component builds on the last.

You can see the flow from a single purchase to the total value over years. It’s a great reminder that small, repeat purchases are what build significant long-term worth.

Putting the Historic Formula Into Practice

Let's make this real. Imagine you run an online boutique based in Dubai. You dig into your sales data from the last year and find a few key numbers:

- Your Average Purchase Value comes out to AED 350.

- On average, customers make a purchase 4 times a year, so that's your Average Purchase Frequency.

- You've determined that the Average Customer Lifespan is about 3 years.

Now, let's plug those numbers into our formula:

(AED 350 x 4) x 3 = AED 4,200

What does this tell you? It means that, on average, each customer has historically been worth AED 4,200 in revenue. That’s a game-changing insight. Suddenly, you have a much better handle on your marketing budget and the true ROI of acquiring a new customer.

The only catch? This model’s biggest strength—its simplicity—is also its weakness. It assumes the future will mirror the past, and in business, that's rarely a safe bet.

The Predictive CLV Model: Forecasting What’s to Come

If you want a more forward-looking view, the predictive CLV model is your next step. This approach moves beyond what has happened to forecast what will happen. It predicts a customer’s future spending, which is incredibly powerful.

While the math can get more advanced—sometimes bringing in statistical models or machine learning—the core idea is still very accessible. Predictive models are fantastic because they can account for market shifts and changes in customer behavior. They help you spot your future VIPs early on, long before their purchase history spells it out.

A simplified predictive formula often factors in metrics like your customer retention rate and a discount rate. The discount rate is an important financial concept; it acknowledges that money you receive today is worth more than the same amount in the future. As you get deeper into CLV, you'll find that understanding the customer retention rate formula is non-negotiable, as keeping customers is the engine of lifetime value.

To help you see the difference at a glance, here’s a quick comparison of the two main models.

Comparing CLV Calculation Models

| Model Type | Core Formula Components | Best For | Limitations |

|---|---|---|---|

| Historic | Average Purchase Value, Purchase Frequency, Lifespan | Businesses new to CLV, companies in stable markets, and anyone needing a quick baseline. | Assumes past behavior predicts the future; doesn't account for churn risk or changing habits. |

| Predictive | Transaction data, behavioral patterns, retention rates | E-commerce, subscription services, and businesses that need high-accuracy forecasts for strategic decisions. | Can be more complex to set up; requires cleaner, more detailed data to be effective. |

As you can see, there isn't one "best" model—it's about what's best for your business right now.

Choosing the Right Model for Your Business

So, which path should you take? It really boils down to your business model and what you're trying to achieve.

-

If you run a subscription-based service, a predictive model is almost always the better choice. You have clear, recurring data on churn and retention, which makes it much easier to forecast future revenue and identify customers who might be about to cancel or upgrade.

-

For a classic retailer or an e-commerce store, starting with the historic model is a fantastic first step. It gives you immediate, valuable information you can act on today. As you grow and your data becomes more robust, you can always graduate to a predictive approach to fine-tune your marketing and retention strategies.

The most important thing is to just start. Calculating CLV, even with the basic historic formula, gives you a massive strategic advantage. It forces a shift in focus from chasing short-term sales to building sustainable, long-term customer relationships. And at the end of the day, that’s what building a great business is all about.

How Loyalty Programs Directly Impact Your CLV

https://www.youtube.com/embed/_zyN3Wa_a7c

Once you've crunched the numbers and have a clear picture of your customer lifetime value, the natural next question is, "How do we make this number bigger?" While plenty of strategies can give your CLV a little nudge, few have the direct, powerful impact of a well-designed loyalty program.

Think of it this way: loyalty programs aren't just about handing out discounts. They are strategic tools that get right to the heart of the CLV formula, influencing the very variables you're trying to improve.

A compelling loyalty program gives customers a powerful reason to choose you again and again, even when competitors are vying for their attention. This has a direct effect on Purchase Frequency, one of the core multipliers in the CLV equation. When people know their next purchase gets them closer to a tangible reward, they're simply more likely to come back sooner.

This isn't just theory; it plays out in highly competitive markets every day. Take the UAE and the broader Middle East and Africa region, for instance. Here, loyalty programs have become a non-negotiable part of customer retention. Research shows that more than 50% of consumers in MEA are active members of loyalty schemes offering discounts and freebies. This kind of consistent engagement makes customer spending habits far more predictable, which is exactly what you want when calculating CLV. You can see more data on MEA loyalty trends from Euromonitor.

Moving Beyond Points for Purchases

The best loyalty programs I've seen go way beyond the basic "spend money, get points" model. They're designed to reward deeper engagement and turn customers into advocates, which builds a much more resilient relationship—and a higher CLV.

Instead of only rewarding transactions, why not reward other valuable actions? This shift transforms your program from a simple discount machine into a genuine community-building tool. These smaller interactions forge a stronger bond with your brand, making customers far less likely to churn.

Here are a few ideas to get you started:

- Reward Social Engagement: Give out a few points when a customer follows you on social media or shares a post about their new purchase. It's a fantastic way to build brand awareness while making the customer feel more plugged into your world.

- Incentivize Reviews: We all know how valuable customer reviews are. Offering a small reward for writing one is a simple and effective way to encourage participation and generate powerful social proof.

- Create Tiered Levels: Structuring your program with tiers (think Bronze, Silver, Gold) gamifies the experience. As customers spend more, they unlock better perks, which naturally encourages them to increase their Average Purchase Value just to hit that next level.

By rewarding behaviors, not just purchases, you change the entire dynamic. Customers start to feel like they're part of a community they're invested in, not just a consumer in a transaction. That emotional investment is a massive driver of long-term loyalty.

Designing a Program That Lifts CLV

Ultimately, a loyalty program is an investment in your most valuable asset: your customers. The goal is to design it so that it measurably improves the core metrics that make up your CLV. A great program doesn't just keep customers around; it actively encourages them to spend more.

Let's break it down by the three core components of the historic CLV calculation:

- Average Purchase Value: Exclusive early access to new products or special bundles just for members can drive up basket sizes. A classic "spend AED 400, get a free gift" offer works wonders here.

- Purchase Frequency: Time-sensitive offers, like a "double points weekend," create a sense of urgency. It gives customers a compelling reason to buy now instead of putting it off.

- Customer Lifespan: A well-built program is one of the most effective customer retention strategies out there. When customers have racked up points or achieved a high status tier, they have a powerful reason to stick with you. Leaving means giving up the value they've worked to build.

By tying your loyalty initiatives directly to these metrics, you can clearly see the ROI of your program. It stops being a cost center and becomes what it should be: a true engine for growth.

Putting Your CLV Insights into Action Company-Wide

So, you've calculated your customer lifetime value. What now? That number you're holding isn't just a metric; it's a strategic guide. The real magic happens when you stop seeing CLV as a static data point and start using it to shape daily decisions across every single department.

This is the moment CLV becomes an active tool for driving real, sustainable growth. It creates a common language that finally aligns your marketing, product, and customer service teams around one powerful goal: nurturing high-value customer relationships.

Optimizing Marketing Spend with the CLV-to-CAC Ratio

For your marketing team, the most powerful and immediate use of CLV is mastering the CLV-to-CAC (Customer Acquisition Cost) ratio. This straightforward comparison is a total game-changer for allocating your budget and fine-tuning your campaigns. It answers the one question that keeps every marketer up at night: are we paying the right price to bring in new customers?

As a rule of thumb, a healthy ratio is around 3:1. This means a customer's lifetime value is three times what you spent to get them. Knowing this stops your team from burning cash on acquiring low-value customers who are just going to churn anyway.

Instead, they can confidently shift their budget to attract prospects who look just like your best, high-CLV customers. This isn't just about getting more customers; it's about getting the right ones. To really nail this down, you’ll want to get serious about https://grassrootscreativeagency.com/marketing-campaign-tracking/ to connect your spending directly to your results.

CLV turns your marketing budget from a calculated guess into a strategic investment. When you know what a customer is worth, you know precisely what you can afford to spend to win their loyalty.

Guiding Product Development with CLV Segmentation

Your product team can also find incredible clarity in your CLV data. By breaking down your customer base into segments based on their lifetime value, you can see exactly which features and products your most profitable customers love the most. It's like having a direct line into what they truly want from you.

Picture this: your team is debating which of two new features to build next. By digging into the usage data of your high-CLV segment, you might find they’re already heavy users of a related feature. Suddenly, the choice becomes obvious—you build the feature that complements their existing behavior.

This data-backed approach ensures your valuable development resources are focused on enhancements that will genuinely delight your most important customers, boosting their satisfaction and keeping them around for the long haul.

Enhancing Customer Service and Support

Let’s be honest: not all customers need the same level of support. CLV helps you tailor your service strategy in a way that’s both smart and effective. Knowing a customer's lifetime value allows you to make better decisions about where to invest in those premium, white-glove support experiences.

For instance, you could set up a system that automatically flags incoming support tickets from high-CLV customers, routing them directly to your senior agents. This isn't about giving other customers bad service; it's about protecting your most valuable revenue streams.

This customized approach is paying off big time in the GCC. Retailers in the UAE and neighboring markets are seeing CLV jump by 20% to 30% simply by using tiered memberships and personalized promotions to improve retention. These results show that a one-size-fits-all model just can't compete with a strategy that recognizes different customer values.

Ultimately, to get the most out of this metric, you have to put it to work with actionable strategies for increasing customer lifetime value. When you transform CLV into a company-wide compass, every team starts pulling in the same direction—toward building a more profitable and customer-focused business.

Got Questions About CLV? You're Not Alone.

When you first dive into calculating customer lifetime value, it's easy to get a little tangled up in the formulas and data points. It can feel complex, but I promise the core ideas are simpler than they look. Let's walk through some of the most common questions I hear from business owners to clear things up.

Customer Lifetime vs. Customer Lifetime Value: What's the Difference?

This is probably the most frequent point of confusion, and for good reason—the terms sound almost identical. But they measure two very different, though related, things.

- Customer Lifetime is all about time. It’s simply the average amount of time someone remains a paying customer. Are they with you for two years? Five years? This is the "how long."

- Customer Lifetime Value (CLV) is all about money. It’s the total profit you expect to earn from a customer over their entire relationship with your business. This is the "how much."

You can't really get to the "how much" without first having a handle on the "how long." One informs the other.

Which CLV Model Should I Use?

Another big question is whether to use a historic or predictive model. There’s no single right answer here; it really boils down to your business model and how deep you're ready to go with your data.

A historic model is the perfect place to start. It’s straightforward, relies on past purchase data, and gives you a solid baseline you can act on immediately. If you're running a retail shop or a new e-commerce brand, this is your go-to.

A predictive model, on the other hand, is a bit more advanced. It's fantastic for businesses with recurring revenue, like a SaaS or subscription box, because it forecasts future behavior. It often involves more complex analysis (sometimes even machine learning) but pays off by being incredibly accurate for long-term strategic planning.

My best advice? Just start. Don't let the idea of a complex predictive model keep you from calculating a simple historic CLV today. The insights you gain from that first calculation are more than enough to start making a real impact.

How Do I Figure Out the CLV for a Single Customer?

Calculating an average CLV for your entire customer base is a great first step, but what about a single person? This is incredibly practical, especially for your customer service team. Knowing an individual's potential value can completely change how you handle a complaint or a refund request.

To do this, you'll still need that average customer lifespan figure you've already calculated. Then, you just multiply that individual customer's average annual spend by the lifespan.

For instance, maybe you have a customer who has spent AED 1,800 over the last two years. That's an average of AED 900 per year. If your average customer lifespan is five years, that one customer's estimated CLV is a cool AED 4,500. Suddenly, offering a "returnless refund" on a small item seems like a brilliant move to keep a valuable relationship intact.

What If I Don't Know My Churn Rate? Can I Still Calculate CLV?

For businesses that aren't based on subscriptions, figuring out customer lifespan can feel like guesswork. Customers don't formally "cancel"—they just stop showing up. This is where your churn rate becomes a powerful stand-in.

If you can't track a customer's journey from their first purchase to their last, you can estimate their lifespan with a simple formula:

Average Customer Lifespan = 1 / Churn Rate

Let's say you have a monthly churn rate of 5% (or 0.05). The math is simple: 1 divided by 0.05 gives you an average customer lifespan of 20 months. Just like that, you have a data-backed number to plug into your CLV calculations, making this valuable metric accessible no matter what kind of business you run.

At Grassroots Creative Agency, we believe that understanding your customers is the foundation of growth. We use data-driven insights, like CLV, to build bespoke digital marketing strategies that deliver measurable results. Learn how our approach can elevate your brand's performance.