At its core, the customer acquisition cost formula is refreshingly simple: your total sales and marketing spend divided by the number of new customers acquired over a specific period. This single number tells you, on average, exactly how much you're paying to bring one new customer through the door.

Decoding the Customer Acquisition Cost Formula

While the math is straightforward, the real power of CAC comes from digging into the details. A truly accurate calculation requires you to get granular with your expenses. It’s not just about what you dropped on your latest Google Ads campaign or social media push; it's about every single dirham spent to convert a prospect into a paying customer.

Nailing Down Your Total Spend

To get a true picture of your CAC, you need to tally up all the associated costs. While the fundamental approach is the same globally, the specific line items for a business in the UAE will have their own local flavor.

The key is to be thorough. A comprehensive calculation needs to include everything from the big-ticket items to the smaller, easily forgotten expenses. To help you get started, this table breaks down the core components.

Core Components of Your CAC Calculation

| Formula Component | What It Includes (Examples for UAE Businesses) |

|---|---|

| Total Sales & Marketing Spend |

|

| Number of New Customers |

|

By compiling all these figures, you create a complete and honest picture of your investment. Getting this part right is non-negotiable for an accurate CAC. You can find more details on what these costs cover by exploring insights about customer acquisition cost calculation.

Pinpointing Your New Customers

The other side of the equation is just as important: the number of new customers you've brought in. It is absolutely critical to only count first-time customers for the period you're measuring. If you mix in repeat buyers, you’ll artificially lower your CAC and get a misleading view of your acquisition efforts.

Your CAC is a direct reflection of your business's health. A low, sustainable CAC means your marketing engine is efficient and your business model is built for growth. A high CAC, on the other hand, is a red flag that signals it's time to re-evaluate your strategy.

Let's put it into a real-world context. Imagine your total sales and marketing spend for the last quarter was AED 100,000, and in that time, you signed up 500 new customers. Your CAC would be AED 200.

This one number gives you a powerful benchmark. With it, you can confidently measure performance, test out new channels, and make much smarter financial decisions. For any business serious about sustainable growth and profitability in the competitive UAE market, mastering this metric isn't just a good idea—it's essential.

How to Reliably Track Your Sales and Marketing Spend

The customer acquisition cost formula is only as good as the data you feed it. If you’re just guessing at your numbers, you're getting a warped view of your business's health. To get a truly accurate CAC, you need a solid, repeatable process for tracking every single dirham you spend to win a new customer.

This isn’t just about glancing at your ad dashboards. It’s about getting into the weeds. You’ll need to pull financial reports from your accounting software (think Xero or QuickBooks) and then meticulously cross-reference that data with what you see in your CRM and various ad platforms. For example, your Google Ads dashboard will show your ad spend, but it won't show the agency fees you paid to manage those campaigns—that’s where your accounting software tells the full story.

Identifying Every Marketing and Sales Cost

I’ve seen it time and time again: businesses under-report their spending. It’s the most common mistake. They'll diligently track their monthly Meta Ads budget but completely overlook the "hidden" costs that quietly push their real CAC through the roof.

To get this right, you have to think bigger than just ad spend. A truly accurate calculation means creating a comprehensive checklist. Here’s what often gets missed:

- Prorated Salaries and Benefits: This is a big one. You need to account for the wages of your marketing team, your sales reps, and even a portion of a founder's salary if they're hands-on with acquisition.

- Agency and Freelancer Fees: That monthly retainer for your digital marketing agency? The one-off project with a graphic designer or SEO consultant? It all counts.

- Technology and Software Subscriptions: Think about all the tools that make your marketing and sales engine run. Your CRM (like HubSpot), email marketing platform, analytics software—every subscription adds up.

- Creative and Content Production: Don't forget the costs tied to video shoots, professional photos, or even developing those in-depth blog posts. These are all part of the acquisition puzzle.

Capturing every expense, no matter how small, is non-negotiable. An overlooked software subscription or a one-off creative fee can significantly alter your CAC, leading to misinformed strategic decisions. Make this a disciplined, month-over-month habit.

Connecting Spend to Results

Once you have a firm grip on your total costs, the next piece of the puzzle is figuring out where your new customers are actually coming from. This is all about attribution. You need to know which channels are delivering the goods so you can double down on what works and cut what doesn't. For instance, properly tracking your email campaigns with Google Analytics lets you tie revenue directly back to that channel's specific costs.

This is where setting up robust marketing campaign tracking becomes your best friend. It’s the essential framework that connects the money you spend to the customers you gain. For a deeper dive, check out our guide on how to implement this: https://grassrootscreativeagency.com/marketing-campaign-tracking/.

Turning this into a routine transforms a messy data-pulling task into a powerful business habit. It gives you the clarity you need to use the customer acquisition cost formula effectively and make decisions with confidence.

Putting the CAC Formula into Practice with UAE Examples

Knowing the customer acquisition cost formula is great, but the real magic happens when you apply it to the unique business landscape here in the UAE. So, let's move past the theory and dive into some real-world scenarios for local businesses. Walking through the numbers for different companies helps make the whole concept click.

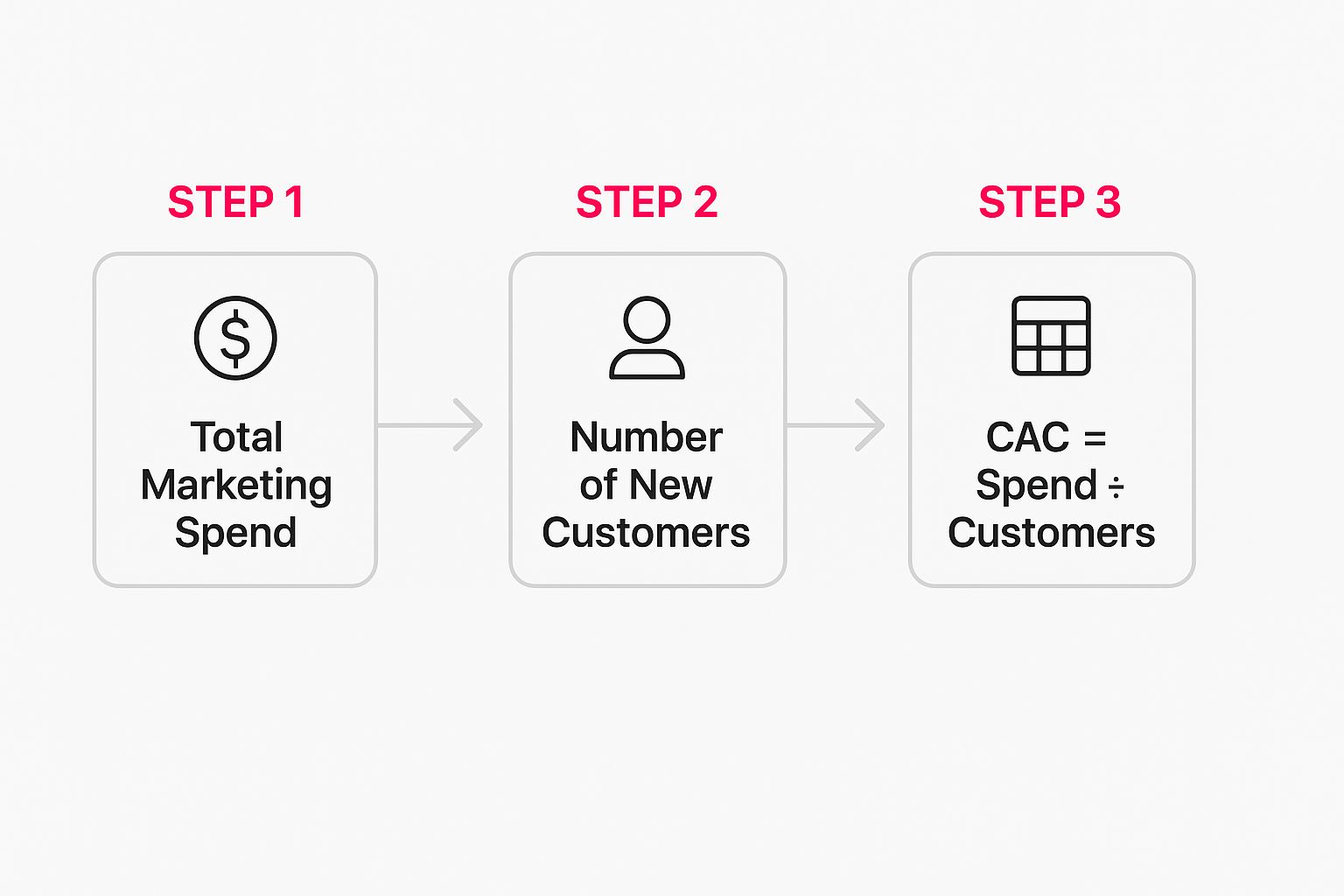

This simple breakdown shows the core calculation in its most essential parts.

As you can see, it really just boils down to your total investment divided by the number of new customers you won because of it.

Scenario 1: The Dubai E-commerce Startup

Let's start with a new fashion e-commerce brand based right here in Dubai. For the last quarter, their main goal was aggressive growth. To get there, they went all-in on social media ads and influencer marketing, trying to capture the attention of a young, style-savvy audience.

Here’s a snapshot of their quarterly spending:

- Meta & TikTok Ads: AED 45,000

- Influencer Collaborations: AED 20,000

- Marketing Team Salaries (2 people): AED 60,000

- E-commerce & Analytics Software: AED 5,000

Their Total Sales & Marketing Spend adds up to AED 130,000. In that same period, they brought in 850 new customers.

Now, let's run the numbers:

CAC = AED 130,000 / 850 customers = AED 152.94 per customer

This figure is their new baseline. They now know it costs them a little over AED 150 to get someone to make that crucial first purchase.

Scenario 2: The Abu Dhabi B2B Tech Company

Next, picture a B2B SaaS company in Abu Dhabi that sells project management software. Their sales cycle is much longer, and their marketing is all about building credibility and generating high-quality leads through big industry events and super-targeted digital campaigns.

Their quarterly costs look quite different:

- LinkedIn Ads & Content Promotion: AED 30,000

- GITEX Event Sponsorship & Booth: AED 70,000

- Sales & Marketing Salaries (3 people): AED 105,000

- CRM & Sales Tools (HubSpot): AED 15,000

This brings their Total Sales & Marketing Spend to AED 220,000. Over the quarter, they successfully closed deals with 40 new corporate clients.

Let's calculate their CAC:

CAC = AED 220,000 / 40 new clients = AED 5,500 per client

While AED 5,500 might seem steep compared to the e-commerce brand, this is completely normal in the B2B world. The key is that the lifetime value of each client—which is often in the tens of thousands of dirhams—more than justifies this initial cost.

Scenario 3: The Service-Based Agency

Finally, let’s consider a creative agency in Dubai. Their growth hinges on reputation, solid networking, and direct outreach. Here, the costs are less about ad spend and more about the human hours poured into securing new business. Many agencies live and die by their ability to generate strong leads, making effective lead generation in Dubai a top priority.

Here's what their quarterly spending might look like:

- Business Development Manager Salary: AED 45,000

- Portfolio & Website Hosting: AED 3,000

- Networking Event Memberships: AED 2,000

Their Total Sales & Marketing Spend is a lean AED 50,000. In the last three months, they landed 5 new clients on monthly retainers.

Applying the formula one last time:

CAC = AED 50,000 / 5 clients = AED 10,000 per client

As you can see from these examples, the CAC formula is flexible. It adapts to wildly different business models and market dynamics, giving you a clear, honest number no matter what you sell.

What Your CAC Number Actually Means for Your Business

So, you've done the math and have your Customer Acquisition Cost. Great. But that number, sitting all by itself, doesn't tell you the whole story. Its real value comes from what it reveals about the health and long-term viability of your business.

Think of your CAC as a financial health check. A high CAC might be a red flag, pointing to leaky marketing funnels or inefficient spending. On the flip side, a surprisingly low CAC could mean you've hit on a brilliant growth strategy that’s firing on all cylinders.

To truly make sense of your CAC, you have to look at it alongside other key marketing metrics like CVR and LTV. The most powerful comparison, by far, is between what it costs to land a new customer and how much that customer is actually worth to you.

The LTV to CAC Ratio Explained

This is where the magic happens. The Lifetime Value (LTV) to CAC ratio is the ultimate scorecard for your marketing ROI. Your LTV is the total revenue you can realistically expect from a customer over the entire time they do business with you. It’s not just about the first sale; it's about all of them.

When you put LTV and CAC side-by-side, you get an instant, crystal-clear view of your profitability.

Are you spending AED 200 to acquire a customer who only ever spends AED 150? That’s a fast track to going out of business. But what if you spend that same AED 200 to land a customer who ends up generating AED 800 in revenue over their lifetime? Now you're talking. That's a scalable, healthy business model.

Key Takeaway: For most businesses, particularly in SaaS and e-commerce, a healthy LTV to CAC ratio is 3:1. This means for every dirham you spend acquiring a customer, you're getting three dirhams back. A 1:1 ratio means you're just breaking even, and anything less means you're actively losing money with every new sign-up.

UAE Industry Benchmarks for Customer Acquisition Cost

It's also crucial to remember that CAC isn't a one-size-fits-all metric. What's considered high for an e-commerce brand might be perfectly normal for a B2B software company. Context is everything. Comparing your CAC to industry benchmarks in the UAE can tell you if you're on track, overspending, or outperforming the competition.

Here's a quick look at what you can generally expect to see across different sectors in the UAE.

| Industry | Average CAC Range (USD) | Ideal LTV:CAC Ratio |

|---|---|---|

| SaaS Companies | $600 – $800 | 3:1 or higher |

| B2B Companies | $500 – $700 | 3:1 or higher |

| E-commerce | $50 – $100 | 4:1 or higher |

As you can see, companies in every sector are aiming for that 3:1 or even 4:1 ratio to fuel sustainable growth. A higher ratio for e-commerce often reflects the need to account for lower average order values and the importance of repeat purchases.

Ultimately, your CAC is more than just a number for a spreadsheet. It's a call to action. It’s a powerful guide that tells you where to fine-tune your marketing, adjust your pricing, and build a more profitable business for the long haul.

Proven Ways to Bring Down Your Customer Acquisition Cost

Figuring out your CAC is just the starting line. The real race is won by actively bringing that number down. A high customer acquisition cost can bleed your budget dry and slam the brakes on growth, but the fix isn't always about cutting your marketing spend. The goal is to get smarter with your money, not necessarily to spend less.

This is about shifting your mindset from pure acquisition to overall efficiency. By making small, strategic tweaks across your entire marketing and sales process, you can make a huge dent in your costs while actually attracting better customers. It's all about finding the right levers to pull for your specific business.

Tune Up Your Conversion Funnel

The most direct path to a lower CAC is getting more of your website visitors to actually buy something. If you can convince more people to convert without cranking up your ad spend, your acquisition cost automatically drops. This is where getting your hands dirty with testing really pays off.

Start with your landing pages. Are they clear? Compelling? Do they guide the visitor toward one specific action? Run some A/B tests to see what works. Pit different headlines, calls-to-action (CTAs), and page layouts against each other. Even a tiny lift in your conversion rate—say, from 1% to 2%—effectively slashes your CAC in half for that channel.

But don't stop at the landing page. Look at the entire journey your customer takes:

- Sharpen Your Ad Targeting: Are you sure you're talking to the right people? Dive into your ad platform's analytics. Start excluding demographics or interests that just aren't converting. This immediately stops you from wasting money on clicks that go nowhere.

- Simplify Your Checkout: If you're running an e-commerce store, a clunky checkout process is a classic conversion-killer. How many steps does it take? Can you remove any unnecessary form fields? Make it smooth and painless.

- Boost Your Site Speed: We've all been there. A website that takes forever to load is frustrating. A slow site kills conversions before you even have a chance. Optimizing your site's performance can give you an instant lift.

I’ve personally seen businesses here in Dubai slash their CAC by over 30% just by getting serious about organic traffic. They invested in good content and solid SEO, building an asset that now brings in high-quality leads every single month for a fraction of the cost of paid ads.

Lean Into Retention and Referrals

It might sound strange, but one of the best ways to improve your acquisition costs is to focus on the customers you’ve already won. Happy, loyal customers aren't just a source of repeat business; they're your most powerful marketing channel. Improving retention makes your LTV:CAC ratio look much healthier, which means that initial spend to get them in the door becomes far more profitable over time.

This is exactly why building solid customer retention strategies is so critical. You can get a much deeper look at creating loyal customers in our guide right here: https://grassrootscreativeagency.com/customer-retention-strategies/.

On top of that, a formal referral program can turn your existing customers into a genuine acquisition machine. Offer a small reward—a discount, some store credit—and you give happy customers a nudge to spread the word. This brings in new business for a tiny fraction of what you'd spend on traditional ads. For more fresh ideas on getting the most out of your ad channels, a good digital advertising blog is always worth a read.

By pairing a better user experience with smart retention tactics, you build a sustainable, cost-effective way to grow your business.

Diving Deeper: Common Questions About CAC

Even when you've got the formula down, some practical questions always come up when you start plugging in your own numbers. Let's tackle a few of the most common ones I hear from clients, so you can calculate and use your CAC with real confidence.

What's the Right Timeframe for Calculating CAC?

This is a classic "it depends" scenario, but I can give you some solid guideposts. For most businesses, especially in the e-commerce world, calculating your CAC on a quarterly basis is the sweet spot. A quarter is long enough to even out any weird weekly spikes or dips but short enough that you can still react quickly and adjust your marketing.

On the other hand, if you're in a business with a much longer sales cycle—think B2B enterprise software where deals take months to close—a six-month or even annual calculation will give you a much more realistic picture. The golden rule is to pick a timeframe that actually reflects how long it takes for a lead to become a customer, and then stick with it for consistency.

Should I Include Returning Customers in My Calculation?

This is a big one, and the answer is a hard no. It's a common mistake that can seriously mess with your numbers.

The customer acquisition cost formula is exclusively about one thing: figuring out the cost to get a brand-new customer in the door. If you start mixing in your loyal, returning customers, your CAC will look artificially low. It might feel good, but it gives you a dangerously false read on how effective your marketing really is at attracting new business.

Remember, the whole point of tracking CAC is to analyze the cost of acquisition, not retention. Keep your new customer data completely separate from your existing base. This is non-negotiable for getting accurate, actionable insights.

Help! My CAC Seems Way Too High. What Now?

First, don't panic. A high CAC is a data point, not a death sentence. The very first thing to do is put it in context by looking at your Customer Lifetime Value (LTV).

A healthy LTV to CAC ratio is generally considered to be around 3:1. If you're hitting that or better, a high CAC might be perfectly fine, especially for businesses selling high-ticket items or long-term subscriptions. You're spending more, but you're getting much more back over time.

However, if that ratio is looking weak, it's a clear signal to start digging into your spending. Where's the inefficiency? Are your ad campaigns bleeding money? Is your website's conversion rate in the basement? A high CAC is often a spotlight shining on a leaky part of your marketing funnel that you can patch up and optimize.

Ready to take control of your marketing spend and drive real growth? Grassroots Creative Agency specializes in building data-supported strategies that lower your CAC and maximize your ROI. Let's build a more profitable future for your brand together.